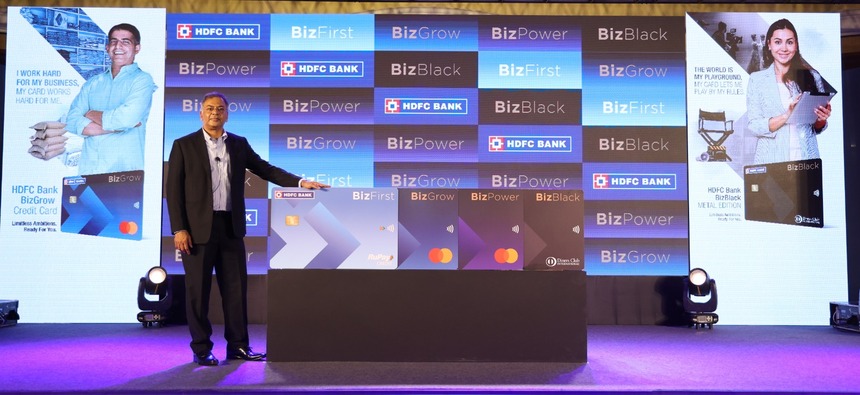

Ahmedabad, February 6th, 2024: HDFC Bank, India’s largest private sector bank, today announced expansion of its SME Payment Solutions with the launch of Business range of credit cards customised for business owners, entrepreneurs, and freelancers. The credit cards will be available in 4 variants – BizFirst, BizGrow, BizPower, and BizBlack. The business credit card range offers a best-in-class interest-free credit cycle of 55 days, savings on core business spends like utility bills, GST, income tax, vendor payments, business travel, and business productivity tools.

This offering makes up a part of the strong suite of SME payments solutions that the Bank offers. HDFC Bank’s SME Payment Solution is a designed to meet the diverse payment needs of self-employed individuals, SMEs and MSMEs.

Tailored to address both payable and receivable needs of businesses, the Bank has introduced a unified digital platform which consolidates all payables such as vendor payments, utility bills, and statutory payments etc. On the receivable side of payments, the platform is designed to manage and optimize end to end supply-chain arrangements and reconciliation. The platform provides a detailed dashboard with one view of payments made and accepted, for better cash-flow management. The Bank leads the commercial spends market with a significant 45% market share as of December 2023.

The new range of business credit cards is envisioned to cater to the requirements of the self-employed community including MSMEs, startups, professionals, and freelancers.

Freelancers/GIG workers is a new emerging segment in self-employed category and the Bank will be launching GIGA Business Credit Card shortly, catering to specific needs of this segment.

Speaking at the launch, Mr. Parag Rao, Country Head – Payments, Liabilities Products, Consumer Finance & Marketing HDFC Bank said, “At HDFC Bank, we are committed to addressing the diverse payment needs of the self-employed as well as the business sector, ranging from MSMEs to large corporates. Understanding the specific requirements of the self-employed community, our business range of credit cards, is designed to be a practical game-changer in supporting their everyday business needs.”

In fact, the recently introduced payments platform has capabilities to process statutory payments, utility bills, onboard verified vendors and centralized payments, providing custom dashboards and comprehensive MIS. Currently, 6,500 corporates are making payments to over 14,000 registered vendors on the platform, facilitating a total spend of Rs 82,000 crores since November 2021. Moreover, the Bank’s Business & Commercial Payment Solution has efficiently processed Rs 26,000 crores in statutory payments in current financial year, establishing itself as a trusted and efficient financial partner for businesses.

HDFC Bank is among the country’s largest facilitators of cashless payments with 5.30 crore debit cards and 2 crore credit cards as of January 2024. HDFC Bank has the largest market share by spends in the credit card business of 27.1% as of December 2023.